Airtel added 5.5 million new subscribers in December 2020, the highest in the past 14 months. The same Reliance Jio has added 32 lakh, new customers. In such a situation, the number of subscribers between Jio and Airtel is decreasing.

The figures for December 2020 are disturbing to Jio. On the other hand, this is the 5th consecutive month in which Airtel’s subscriber growth has been recorded. Airtel continues to thrive in terms of new customers. Airtel added 5.5 million new subscribers in December 2020, the highest in the past 14 months. The same Reliance jio has added 32 lakh new customers. In such a situation, the number of subscribers between Jio and Airtel is decreasing. This makes the Airtel company just a short distance away from becoming the country’s top telecom company, which is a cause for concern for Jio.

Heading Towards No.1 Telecom Subscriber Base

Airtel has achieved sharp growth in the second quarter of 2020. Airtel has added over 22 million shares during July to December 2020. At the same time, Jio has to satisfy with 11 million. Since September, Airtel’s stock has been growing at 40%. Also, the number of subscribers of the company is increasing every month. Airtle also tops in the number of active subscribers with 33.7 per cent. The same Jio is at second place with 33.6 per cent. At the same time, Vodafone-Idea comes with 26.3 percent. In December 2020, Airtel’s userbase increased to about 33.87 crore. Jio’s user base is 40.87 crore. But there is still a difference of about 7 crore customers to become the top company between the two.

In fact, the farmer movement has been going on for the last several months, from where an atmosphere has been created against jio. Subsequently, Jio’s network was disrupted in states including Punjab. Due to this, Jio users are facing the problem of call drop, not getting network. This is the reason Jio has been suffering for the past few months.

State-owned MTNL also lost 6,016 mobile service customers, while BSNL added 556 new mobile users.

With 35.34 per cent market share, Reliance Jio remained India’s biggest telecom operator by market share, while Airtel retained second spot with 28.97 per cent market stake. Vi’s market share shrunk to 25.10 per cent, while PSU units BSNL and MTNL stake stood at 10.3 per cent and 0.3 per cent, respectively, TRAI data showed.

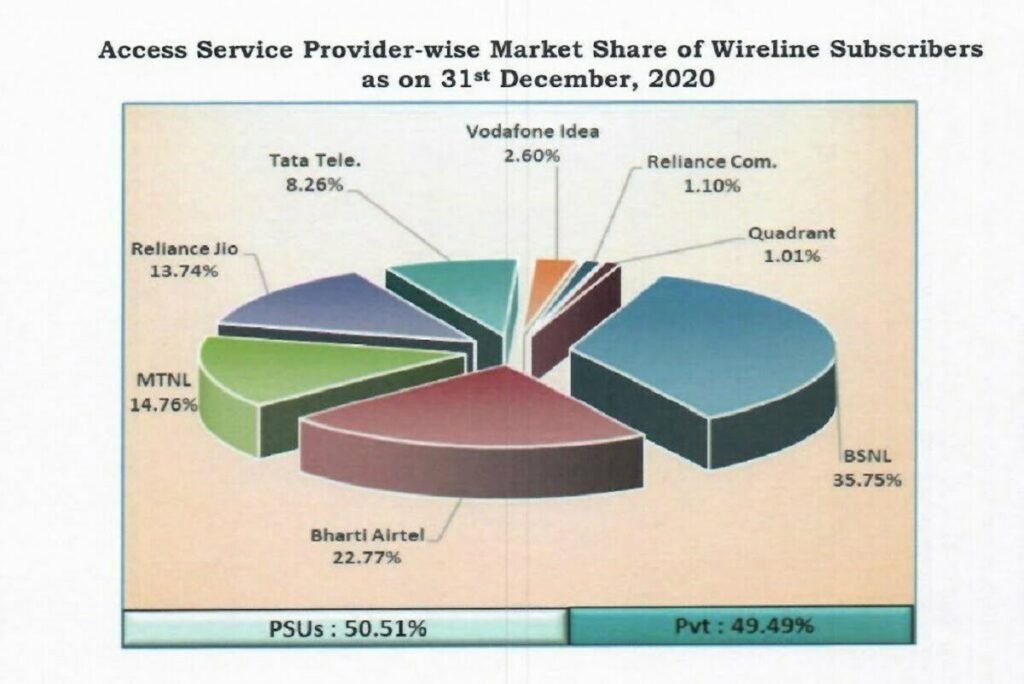

As on November 30, 2020, the private access service providers together held 89.41 per cent market share of the wireless subscribers whereas BSNL and MTNL, the two PSU access service providers, had a market share of only 10.59 per cent.

Despite having the largest market share in the mobile networks, Reliance Jio’s active subscriber base was lower than Airtel and Vi. Of the total customers, Jio’s active subscriber base stood at 79.55 per cent, while Airtel and Vi’s active users were at 89.01 per cent and 96.63 per cent, respectively.

As per the TRAI data, total wireless subscribers in India increased from 1,151.81 million in October 2020 to 1,155.20 million at the end of November 2020, there by registering a monthly growth of 0.29 per cent. Of this, wireless subscription in urban areas was at 630.40 million and 524.80 million in rural area. Monthly growth rates of urban and rural wireless subscription were 0.18 per cent and 0.43 per cent, respectively.

Service area-wise, all states, except West Bengal, Rajasthan, Kolkata, Jammu and Kashmir, and Mumbai, showed growth in their wireless subscribers during the month of November. Madhya Pradesh service area showed maximum growth of 1 percent in its wireless subscriber base during the month.

Meanwhile, 6.81 million subscribers submitted their requests for Mobile Number Portability (MNP) in November. With this, the cumulative MNP requests increased from 529.60 million at the end of October to 536.41 million at the end of November, since implementation of MNP.

Follow TelecomByte for the latest tech news, also keep up with us on Twitter, and Facebook.