Vodafone Idea financial outlook remains bleak as the government denies further AGR relief, increasing pressure on the struggling telecom giant’s future.

Vodafone Idea, a prominent player in the Indian telecommunications sector, continues to face significant financial challenges that have raised concerns among investors, stakeholders, and market analysts. Central to Vodafone Idea’s predicament is the adjusted gross revenue (AGR) dues it owes, which have severely impacted its operational viability. This debt has accumulated due to historical regulatory decisions and legal battles surrounding the definition and calculation of AGR, leading to a substantial financial burden on the company.

As of late 2023, Vodafone Idea’s debt levels have soared, estimated to be in the range of several billion dollars. This staggering amount not only reflects the company’s obligations regarding AGR but also includes various loans and financial commitments essential for maintaining its infrastructure and services. The operational performance of Vodafone Idea has been notably hampered by this debt, as the company contends with dwindling subscriber numbers, intense competition from rivals, and rising operational costs. These factors have culminated in a precarious position, resulting in diminished investor confidence and market standing.

Government relief measures intended to aid telecom companies have, thus far, failed to provide substantial support for Vodafone Idea. While some temporary measures were introduced, including the deferment of certain dues and other leniencies, they have not proven sufficient to alleviate the company’s financial strain. This context underscores the critical nature of Vodafone Idea’s current situation, as its financial outlook hinges on the resolution of these AGR dues and the effectiveness of any future policy interventions aimed at stabilizing the telecom sector. The company’s ability to navigate through its existing challenges will significantly determine its resilience and long-term sustainability within an increasingly competitive market.

Government’s Stance on Financial Relief

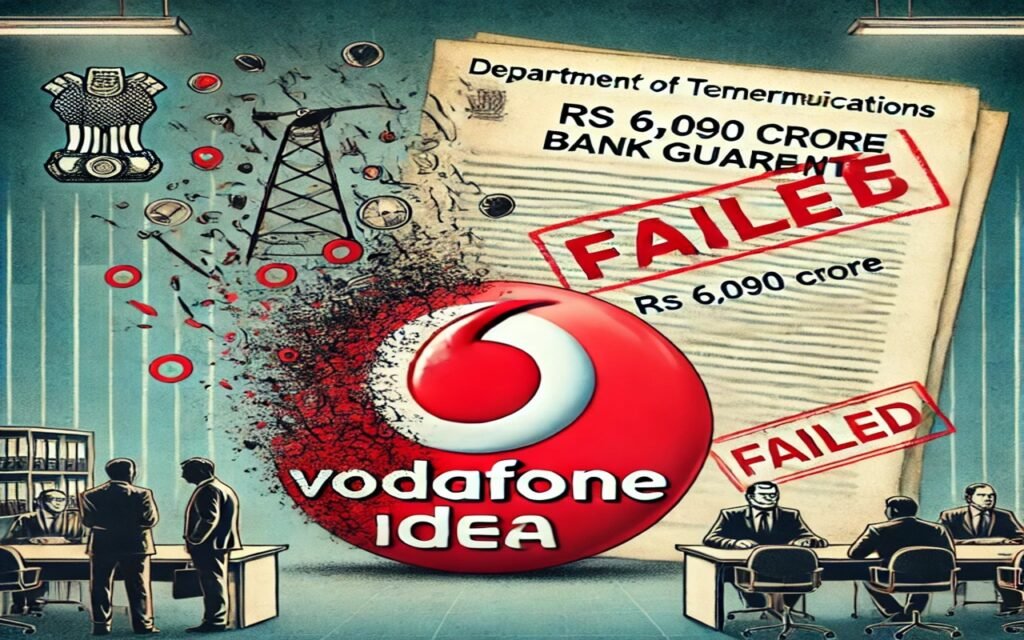

Recently, the Indian government’s position regarding Vodafone Idea’s request for additional financial relief has garnered significant attention. Officials from the Department of Telecommunications (DoT) have indicated that the scope for any further support is narrowing. This stance comes in the context of the ongoing discussions surrounding the company’s substantial Adjusted Gross Revenue (AGR) dues, which has posed challenges for Vodafone Idea’s financial sustainability. The government has also made clear its rejection of equity conversion as a means to alleviate Vodafone Idea’s debt burden. This decision has been a crucial pivot point in negotiations, reflecting the government’s inclination to maintain fiscal responsibility while ensuring the stability of the telecom sector.

The implications of the government’s current position are substantial, not only for Vodafone Idea but also for the broader telecommunications industry in India. Without further financial relief, Vodafone Idea faces mounting pressure to enhance its operational efficiency while managing its existing debt obligations. The rejection of options such as relaxed payment schedules adds to the burden. Stakeholders are concerned that without adequate support, the company may struggle to compete effectively in an already challenging marketplace, characterized by intense competition and significant investment requirements.

Moreover, the decisions made by the government could set important precedents for other telecom operators facing similar challenges. A lack of proactive measures in assisting struggling firms could instigate a ripple effect throughout the sector, raising questions about long-term viability. As the government remains steadfast in its current stance, stakeholders within the industry are left to assess the potential repercussions on market dynamics and consumer choices. It is crucial to scrutinize the governmental policies at this juncture, as they could have far-reaching impacts on the future landscape of telecommunications in India.

Consequences of No Further Relief

The absence of additional financial relief for Vodafone Idea presents several dire consequences for the company. Firstly, the existing high debt levels, which have been a persistent challenge for the organization, are likely to intensify. With the burden of Adjusted Gross Revenue (AGR) dues still looming, Vodafone Idea must navigate a precarious financial landscape. Failing to manage this debt effectively can lead to further downgrades in credit ratings, making it progressively harder for the company to secure requisite funding for its operations and future expansions.

Moreover, without financial reprieve, Vodafone Idea faces immense pressure to enhance its operational performance. The company has been struggling to attract and retain customers amidst stiff competition, primarily from more financially stable rivals. Consequently, it must expedite efforts to optimize costs, improve service quality, and innovate its offerings to regain market share. This operational haste, however, can introduce risks, including potential misallocation of resources, that may detrimentally affect long-term sustainability and profitability.

Raising funds in the current market environment poses another challenge for Vodafone Idea. Investors and lenders are becoming increasingly cautious, particularly towards companies with significant debts. This sentiment directly impacts Vodafone Idea’s ability to raise capital through debt or equity markets. Additionally, the ongoing uncertainty regarding the company’s financial viability has led to growing erosion of shareholder confidence, further exacerbating its difficulties in attracting any external funding. The declining trust from investors could lead to a stagnant share price or substantial declines, diminishing not only the company’s market position but also its overall competitiveness in the telecom sector.

The culmination of these factors may create a vicious cycle, further entrenching Vodafone Idea in its financial struggles and complicating its future trajectory in an already challenging telecom market.

Looking Ahead: The Need for Policy Change

The current landscape of the Indian telecom sector is characterized by a pressing need for policy changes that directly impact the financial health of operators such as Vodafone Idea. The accumulated Adjusted Gross Revenue (AGR) dues and lack of relief measures have placed immense pressure on the company’s operational viability. As stakeholders assess the situation, it becomes increasingly apparent that a reevaluation of governmental policies and regulatory frameworks is essential for promoting a sustainable telecom environment.

One potential pathway for the government involves reassessing the AGR definition itself, which has been a contentious issue for many operators. By clarifying what constitutes revenue and subsequently adjusting the tax obligations, the financial burdens on struggling companies may be alleviated. Such modifications could provide immediate relief, fostering a healthier marketplace and encouraging existing operators to remain competitive without being undermined by unsustainable debt levels.

Additionally, regulatory bodies must foster a more supportive framework that encourages investments in infrastructure and innovation within the telecom sector. By prioritizing policies that focus on technological advancements, operators can create higher-quality services for consumers while enhancing market competition. Supporting public-private partnerships, for instance, would allow for shared investment in critical next-generation network infrastructure, which is crucial for enabling superior connectivity and mitigating systemic risks faced by individual operators.

Moreover, the need for balanced competition must be highlighted. Policies that excessively favor certain market players can lead to monopolistic tendencies, adversely affecting service quality and consumer choice. Therefore, a policy shift that promotes fair competition among telecommunications providers is crucial for ensuring that all players can thrive while simultaneously prioritizing customer satisfaction.

In conclusion, the future of Vodafone Idea and the broader telecom sector relies heavily on strategic policy changes. By addressing tax burdens, fostering infrastructure investment, and promoting equitable competition, the government can significantly improve the overall stability of the telecom market, ultimately benefiting consumers and providers alike.

For the latest tech news, follow TelecomByte on X, Facebook and Google News.