Vi fails to provide a bank guarantee or cash payment for the 2015 spectrum auction shortfall, sparking concerns about potential DoT action.

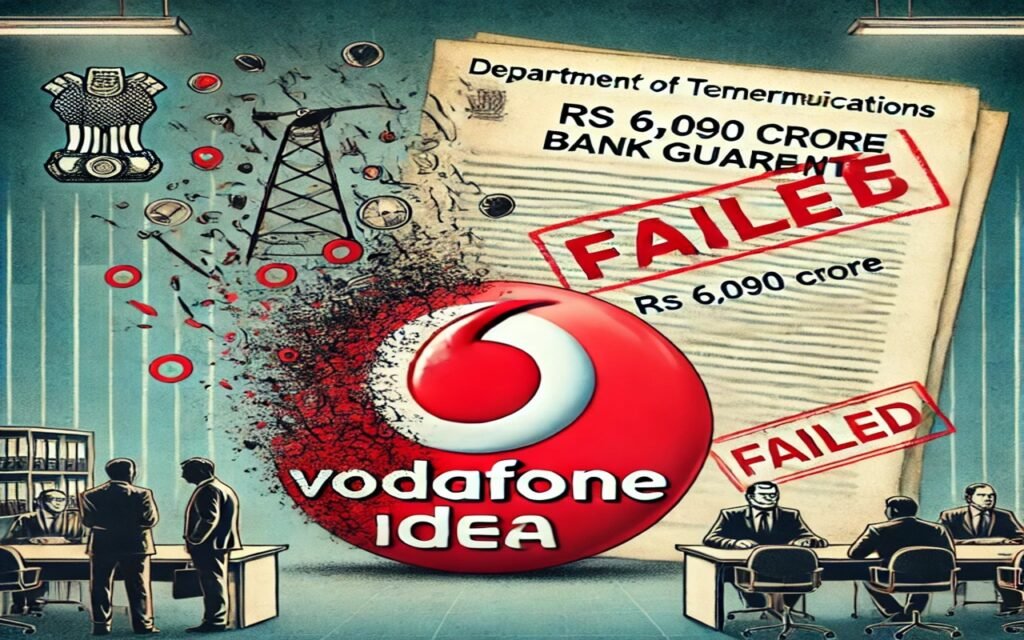

The Department of Telecommunications (DOT) set forth specific requirements regarding the bank guarantee that Vodafone Idea, commonly referred to as Vi, must fulfill. A critical component of these requirements is the provision of a substantial bank guarantee amounting to Rs 6,090.7 crore. This figure arises from shortfalls related to the 2015 spectrum auction, during which significant sums were bid by various telecommunications companies, including Vi. The aim of implementing such bank guarantees is to ensure that telecom operators maintain financial responsibility and meet their commitments towards spectrum payments.

The stipulated deadline for Vodafone Idea to submit the bank guarantee or an equivalent cash payment was established as March 10, 2025. Failure to meet this deadline not only poses financial repercussions for Vi but also invites further scrutiny and possible regulatory action from the DOT. Such consequences include, but are not limited to, loss of operational licenses, increased penalties, and additional interest on the unpaid amounts. As Vi navigates its financial challenges, the ability to adhere to these requirements is critical for sustaining service continuity and maintaining market competitiveness against other operators.

Current Status of Vodafone Idea’s Payment

Vodafone Idea, commonly referred to as Vi, currently faces significant financial challenges that have hindered its ability to comply with the Department of Telecommunications’ (DOT) directives regarding essential payments. One of the most pressing obligations involves the provision of a bank guarantee amounting to Rs 6,090 crore. This requirement is crucial for the continuation of operations and demonstrates the company’s financial health. Unfortunately, Vi has been unable to secure the necessary funds to meet this obligation, leading to serious implications for its operations.

The inability to submit the bank guarantee or cash payment stems from ongoing financial turmoil that has engulfed the company for an extended period. Vodafone Idea has grappled with substantial losses, rising debt, and dwindling subscriber numbers, all of which have exacerbated its inability to fulfill the financial commitments imposed by the DOT. The lack of revenue generation has put immense pressure on the company’s liquidity, thereby limiting its options to source funds through traditional means such as loans or equity financing.

As a result of these financial struggles, the future of Vodafone Idea remains uncertain. Industry experts continue to monitor the situation closely, as the next steps taken by both Vodafone Idea and the DOT will be crucial in defining the next phase of Vi’s trajectory in a highly competitive telecommunications market.

Past Relief Measures and Comparisons with Competitors

Vodafone Idea, commonly referred to as Vi, has encountered significant challenges that have necessitated the implementation of various relief measures to alleviate its financial strain. One prominent relief initiative was introduced in 2021, when the government unveiled a telecom reforms package designed to bolster the sector. As part of this package, the Department of Telecommunications (DOT) waived approximately Rs 33,000 crore in bank guarantees for the telecom operators, thereby providing critical financial respite to Vi during a period marked by intense competition and economic pressure.

Despite these measures, Vodafone Idea has struggled to maintain a stable financial footing. The waiver, while beneficial, did not completely eliminate the company’s obligation towards bank guarantees. The recent failure of Vodafone Idea to provide the required Rs 6,090 crore bank guarantee to the DOT highlights the company’s ongoing challenges in navigating its financial landscape. Unlike its competitors, Bharti Airtel and Reliance Jio, Vi’s position has been further complicated by a one-time partial shortfall, which adds another layer of difficulty to an already daunting scenario.

In contrast, companies like Bharti Airtel and Reliance Jio have managed to meet their regulatory obligations efficiently while capitalizing on market opportunities. Their proactive financial strategies and robust operational models place them in a better position to adapt to regulatory requirements and fend off potential risks. For instance, while Vodafone Idea has been focused on navigating its debt burden, competitors have utilized their market share and technological advancements to enhance their profitability and expand their customer base.

This prevailing disparity raises questions about the future viability of Vodafone Idea within the competitive telecom landscape. The ability of Vi to rectify its financial obligations to the DOT and secure its footing in the market remains a critical issue, emphasizing the need for a strategic approach to stabilize its operations and address the challenges ahead.

Potential Outcomes and Future Actions from the DOT

The recent failure of Vodafone Idea (Vi) to furnish the requisite bank guarantee of Rs 6,090 crore to the Department of Telecommunications (DOT) may initiate a chain of consequential actions and decisions. This scenario raises questions regarding the operational strategy of Vodafone Idea and its financial stability in the increasingly competitive telecom landscape in India. The DOT’s response could manifest in various forms, including potential legal actions or the imposition of additional financial penalties.

One immediate implication could be the initiation of legal proceedings against Vodafone Idea for non-compliance with regulatory requirements. Such legal ramifications could affect the operational license of Vi, thus further compounding their existing financial challenges. The impact of these possible legal actions may not only inhibit Vodafone Idea’s ability to operate smoothly, but could also erode consumer confidence in the brand. In an industry already rife with competition, this erosion could further exacerbate subscriber churn and adversely affect revenue streams.

Moreover, the DOT may impose additional financial penalties that could significantly strain Vodafone Idea’s limited financial resources. These penalties may be directly linked to the delay or non-fulfillment of the bank guarantee obligation, making it a pressing concern for the company. Long-term financial repercussions could lead Vodafone Idea to consider restructuring measures, partnership strategies, or even stake sales in order to maintain liquidity.

In light of these possible actions, the broader telecom industry should brace itself for shifting dynamics. Competitors may leverage this situation to enhance their market positioning, and an overall decline in trust in Vodafone Idea may drive customers to alternate providers. The repercussions of DOT’s actions on Vodafone Idea will reflect a pivotal moment not only for the company but also for policy implementation, regulatory enforcement, and operational practices within the telecommunications sector in India. In summary, Vodafone Idea’s predicament serves as a compelling case study for stakeholders and observers focused on the challenges and regulatory environment of telecommunications in India.

Stay updated with the latest news from the telecom sector by following our channel, Tech News. Don’t forget to connect with us on Twitter, and Facebook for real-time updates and insights.