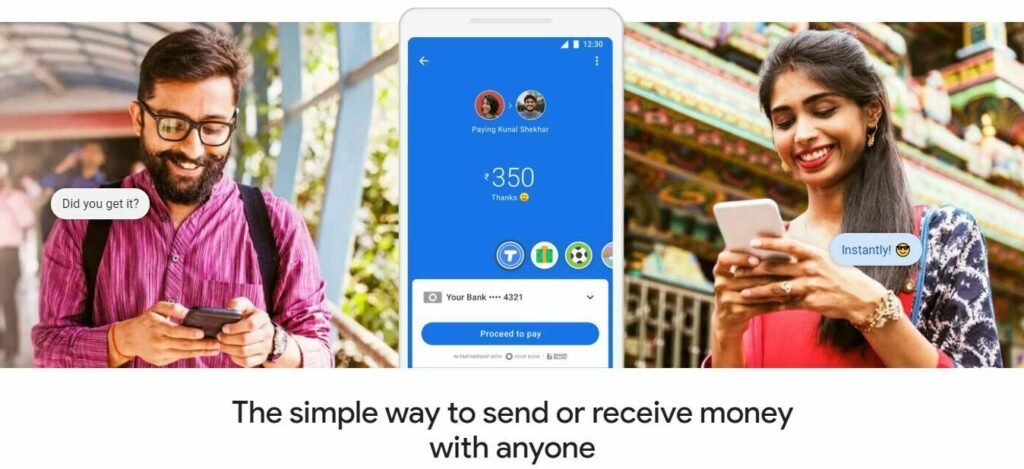

Google Pay announced it is completely revamping the app for its wireless payment system, maintaining the same abilities as before to send and receive payments, but also turning it into an all-in-one money management app.

Google has completely redesigned its digital payment app Google Pay. Google claims that the new change will help its Pay users to save money. Also, users will be able to monitor their expenses. The new changes in its Pay app will be for iOS users with Android. However, from the beginning of Google, the change in Google Pay has been done for US users only. However, soon GooglePay will be updated in the rest of the world including India.

New Google Pay App Features

In the old app of Google Pay, you used to see bank card details and recent transactions on the home page. But not only transaction details will be found in the new Google Pay app, but users will be able to check their daily expenses. In the new app, you will also get a messaging tool along with digital payment.

In the Google Pay app redesign app, the user will be able to track the people who do the most transactions. Also if you click on a contact, then all the old transaction details with it will be visible. It will appear in a chat click bubble. In this chatbox, you will get a payment option, where you will be able to see money requests, bills.

Will handle all your Financial Expenses

There will also be a group chat feature in Google Pay, where you will be able to contribute to a group. Along with this, you will be able to see who has done the transaction and who has not. The best feature of Google Pay is the financial management system. This means that on connecting the card to the app from the user, you will be able to monitor all your expenses with a single click.

Also, the Monthly Vice will be able to see the list of his expenses. At the same time, if you spend more on dinner or party and shopping, then Google will also warn you about it. This will help the user to control their expenses.

The company says the checking and savings accounts offer “no monthly fees, overdraft charges or minimum balance requirements and help you save toward your goals more easily.” There’s little other information for now though.

The all-new Google Play has also made it easier for a group of friends to split a bill. So in order to split the food bill, rent or other expenses users can create a group to split the bill, and keep track of who’s paid in a single place. Google Pay will even help you do the math on who owes what. Google Pay in the US will allow users to buy gas at over 30,000 gas stations and pay for parking in over 400 cities, all from within the app.

Google Pay working on new features

At the same time, the company is also working on a new feature, which will alert you on sending money to a wrong person. Also, you can get the option to customize some new privacy control features. If you talk about privacy, then Google Pay says that user data is not shared with any third party on its behalf.

Google Pay will also help users in saving money and redeeming offers from stores. “If you choose to connect your bank account or cards to Google Pay, the app will provide periodic spending summaries and show your trends and insights over time—giving you a clearer view of your finances,” Sengupta said in the blog.

The search giant has assured that it would never sell users’ data to third parties or share their transaction history with the rest of Google for targeting ads. Apart from all the features, Google has also launched Plex, its mobile-first bank account integrated into Google Pay.